Compare Options

When most become eligible for Medicare, they will generally enroll in Original Medicare (Part A and B) first. Once enrolled, they can then choose to add on other coverage, such as a Medigap plan or a Medicare Advantage plan, but which plan is best for you?

Let’s go over their differences so you can make an informed decision on your coverage!

What is Medigap?

Medicare Supplements (Medigap) will supplement your Original Medicare coverage by filling in the gaps. This means that a Medigap plan will cover costs that Original Medicare will not cover, such as deductibles, coinsurance, copayments, and more. There are more than 138,000 people who have one of the ten Medigap plans available in Louisiana:

There are also two high-deductible plans that are available: High Deductible Plan F and High Deductible Plan G. These plans will provide the same coverage as their standard versions, but will have higher deductibles and lower premiums.

- Compare Options

- Estimate Your Savings

- Help You With Enrollment

What is Medicare Advantage?

Medicare Advantage (Part C) is a part of Medicare that will not supplement Original Medicare but will instead combine its coverage with typically Part D prescription drug coverage and possibly other additional benefits into a single plan. There are multiple Medicare Advantage plans available: PPO, HMO, SNP, MSA, and PFFS. Which plans are available to you will depend on where you live.

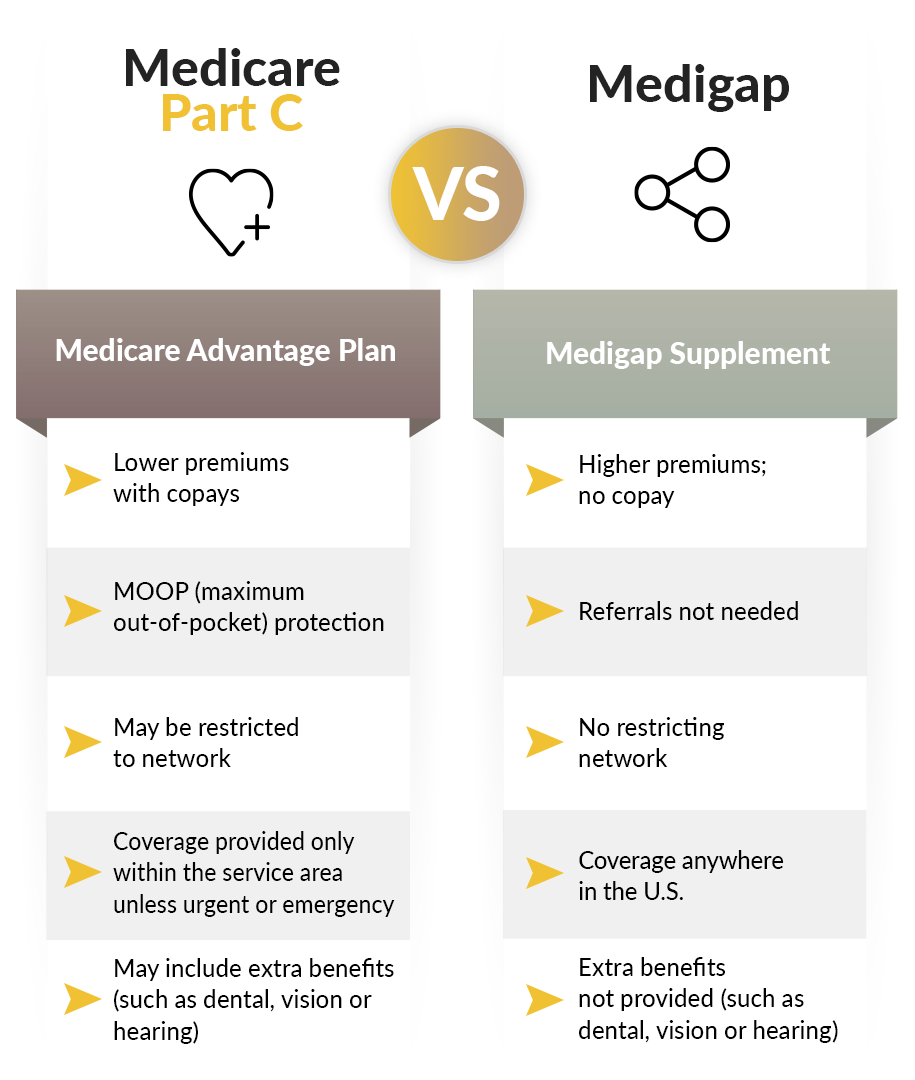

Medigap vs. Medicare Advantage

To choose the coverage that works best for you, it’s important to understand each of your options. Here’s a breakdown of what you can expect from both Medigap and Medicare Advantage.

Have Medicare Questions? We Can Help

Medicare can be complicated, but it doesn’t always have to be! Book a consultation with us today and we can help you find the Medicare coverage that works best for you.